[fusion_builder_container background_color=”” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”10″ padding_bottom=”0″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_3″ last=”no” spacing=”no” center_content=”yes” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”0 5px 0 3px” margin_top=”” margin_bottom=”5px” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”https://dentsubenefitsplus.com/wp-content/uploads/2016/12/2017-DAN-NH-Benefits-Presentation.pdf” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_3″ last=”no” spacing=”no” center_content=”yes” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”0 5px 0 0″ margin_top=”” margin_bottom=”5px” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”http://dev.shaunm60.sg-host.com/wp-content/uploads/2016/10/NewHireBenefitsChecklist2.pdf” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_3″ last=”no” spacing=”no” center_content=”yes” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”0 5px 0 0″ margin_top=”” margin_bottom=”5px” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”http://dev.shaunm60.sg-host.com/wp-content/uploads/2016/10/NewHireBenefitsChecklist2.pdf” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_3″ last=”yes” spacing=”no” center_content=”yes” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”0 5px 0 0″ margin_top=”” margin_bottom=”5px” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”/life-event-guide” linktarget=”_self” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_3″ last=”yes” spacing=”no” center_content=”yes” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”0 5px 0 0″ margin_top=”” margin_bottom=”5px” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”no” gallery_id=”” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”/life-event-guide” linktarget=”_self” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”20″ padding_bottom=”20″ padding_left=”30px” padding_right=”30px” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_text]

[/fusion_imageframe][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”20″ padding_bottom=”20″ padding_left=”30px” padding_right=”30px” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_text]

Overview

Dentsu Aegis Network (DAN) offers a wide range of health & welfare programs through our Flexible Benefits Program as well as voluntary benefit plans through our Lifestyle Benefits Program. All designed to meet the diverse needs of our employees. The Flexible Benefit Program offers a variety of plans from which you can choose the coverage that best meets the needs of you and your family. These include: Medical, Dental, Vision, Flexible Spending Accounts, Life Insurance, and Disability Insurance and a Group legal plan.

Eligibility

Regular full-time and part-time employees working a minimum of 21 hours per week are eligible for the benefitsPLUS Flexible Benefits Program.

[fusion_menu_anchor name=”DependentCoverage”/]Dependent CoverageBack to top

- Spouses (including Same Sex Spouses*)

- Same or opposite sex domestic partners subject to program rules (medical, dental and vision only). Must complete Domestic Partner Affidavit.

- Children up to age 26

Under IRS Regulations for Federal Income Tax purposes your Domestic Partner, and your Domestic Partner’s Child(ren) are not treated as a DP or legal dependents. The IRS requires the company to treat the value of any Medical, Dental or Vision coverage provided to your Domestic Partner as imputed income. For more information please view and complete the Domestic Partner Affidavit. Please view the costs section on the left hand side of this page for more information about employee contributions when covering a domestic partner.

[fusion_menu_anchor name=”MakingAChange”/]Making a changeBack to top

Under IRS rules, your benefit elections must remain in effect until the next plan year which starts on January 1, 2017 unless you have a qualifying life event during the year. A qualifying life event which would include: a change in your marital status, change in your number of dependents (birth, adoption, etc.), change in your work schedule/eligibility or change in dependents status (reaching age 26). You must register your changes within 31 days of the event by visiting this site or by calling the benefitsPLUS solution center at 1-855-326-7870. Please note that dependent verification information may be required when processing a life event.

[fusion_menu_anchor name=”MedicalPlans”/]Medical PlansBack to top

Our PPO medical plans (administered by United Healthcare) give you the flexibility to go in- and out-of-network and offers you cost saving opportunities by selecting the plan that best meets your needs.

To learn more about the Medical plans, review the 2016 Medical Plan Description and check out the UHC Pre-enrollment Website where you’ll find tons of information, plan comparison charts, videos and much more. Once on this site, take a stroll down HealthCare Lane and visit “the bank” for a fun and interactive way to learn about the Health Savings Account PPO Plan which is a High Deductible Health Plan (HDHP) linked to a company funded Health Savings Account (HSA) which allows you to lower your health care premiums and potentially save for your future healthcare expenses.

Please Note: If you do not make any changes to your plan election, a new ID card will not be issued. If this is your first time electing coverage under the DAN UHC plan or you changed medical plans you will be issued a new ID card.

Once you have received your ID card, you can log onto www.myuhc.com to manage both your medical and prescription drug benefits and order additional ID cards. You may also access your personal claim history, find an in-network doctor, access your Health Savings Account and more on this website.

NEW in 2016 Fully Integrated Virtual Visits Benefit

In 2016, MDLIVE, our telemedicine provider, will be replaced with a fully integrated option available through UHC. UHC has rolled out a Virtual Visits benefit with two vendor partners that deliver the same type of service that you are used to with MDLIVE, by allowing you to access care using telephonic or video technology (some limitations may apply by state). Similar to MDLIVE, the Virtual Visits network is available 24/7/365 (including holidays) by phone, video or email from virtually anywhere.

[fusion_menu_anchor name=”PreventiveCare”/]Preventive CareBack to top

Your health coverage with DANbenefitsPLUS covers all the cost of your Preventive Care at 100%. However, you must confirm that your specific type of care is considered Preventive Care under our policies. Please refer to the Preventive Care documents in the Forms bar on the left-hand side of this page for more information on the guidelines for preventive care.

[fusion_menu_anchor name=”DentalPlans”/]Dental PlansBack to top

Our dental plans, administered by Delta Dental gives you the flexibility to go in- and out-of-network and offers cost-savings opportunities through network provider discounts. We offer two Dental plans provided by Delta Dental; Enhanced Plan and Basic Plan.

NEW in 2016: We heard your requests, so in 2016 Adult Orthodontia coverage will be added to the Enhanced Plan.

A Note About Dental Coverage

Your annual maximum illustrated here is the most your plan will pay toward your dental services in a given year. This annual maximum applies to each person covered on the plan. The orthodontia limit of $2,000 in the Enhanced Plan is a lifetime maximum. Unlike your annual maximum, this lifetime orthodontia maximum is the most your plan will pay for orthodontia services per member per lifetime. It does not “reset” each year like your annual maximum.

Review the 2016 Dental Benefits Summary. To learn more about the dental plan offering, to search for an in-network provider or print your ID card visit the Delta Dental website at www.deltadentalins.com.

[fusion_menu_anchor name=”VisionPlan”/]Vision PlanBack to top

Our vision plan administered by VSP provides affordable eye care and discounts to cover routine eye exams, prescription eyeglasses, or contact lenses. Read the 2016 Vision Benefits Summary or to search for an in-network provider the VSP website at www.vsp.com. Please note, you WILL NOT receive an ID card for the vision plan.

[fusion_menu_anchor name=”LifeInsurance”/]Life InsuranceBack to top

Our life insurance plan is administered by UNUM and provides the following coverage and options:

Basic Life Insurance – Our basic life insurance plan is a core benefit provided by the company at no cost to you. Basic life insurance equals two times your annual salary up to a maximum of $350,000 (up to a maximum of $1,000,000 for senior executives).

Supplemental Life Insurance – If you wish to purchase additional life insurance, our supplemental life insurance plan gives you the opportunity to elect one to five times your annual salary, up to a maximum of $1,000,000. You pay the full cost of supplemental life insurance on an after-tax basis.

Spouse Life Insurance – Our spouse life insurance plan allows you to purchase life insurance for your spouse in increments of $10,000 up to the employee supplemental election or $500,000, whichever is less. You must elect supplemental life insurance to elect spouse life insurance. You pay the full cost of spouse life insurance on an after-tax basis.

Dependent Life Insurance – Dependent Life Insurance allows you to purchase life insurance for your child(ren) for $10,000. You must elect employee supplemental life insurance to elect child life insurance.

[fusion_menu_anchor name=”DisabilityBenefits”/]Disability BenefitsBack to top

Disability income replacement helps protect you and your family in the unforeseen event of your illness. The benefitsPLUS Program offers the following benefits:

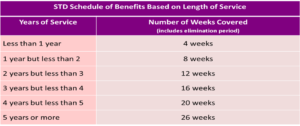

Short Term Disability (STD) – Provides you with 100% of your pre-disability income when you are temporarily out of work due to a non-work related accident or illness. You must notify your HR Partner at least 30 days in advance of a planned disability.

NEW in 2016: The 7 day elimination period will now be company paid.

Long Term Disability (LTD) – If you are out on a disability for more than 26 weeks (6 months) you will become eligible for our Long Term Disability (LTD) plan. DAN provides an LTD benefit at no cost to you. In the event of an illness or accident that requires a lengthy recovery or should you become permanently disabled, you may be eligible for a benefit equal to 60% of your monthly salary up to a new maximum of $20,000 per month. When enrolling, you will have the option of choosing to pay for your LTD coverage so that your LTD benefits will be tax free.

[fusion_menu_anchor name=”FamilyFriendlyBenefits”/]Family Friendly BenefitsBack to top

NEW for 2016: Enhanced Family Friendly benefits

Parental Leave#

In addition to disability benefits that you may receive, Dentsu Aegis Network will be providing you with additional paid time off based upon years of service. In addition we will be expanding our eligibility definition to included Primary and Secondary Caregivers.

| OLD Paid Benefit |

NEW Paid Benefit |

||

| Tenure | All Employees | Primary Caregiver* |

Secondary Caregiver |

| <1 | 0 Weeks | 2 Weeks | 1 Week |

| 1 to <2 | 2 Weeks | 2 Weeks | 1 Week |

| 2 to <3 | 2 Weeks | 4 Weeks | 2 Weeks |

| 3+ | 2 Weeks | 6 Weeks | 2 Weeks |

| *The individual who has primary (more than 50%) responsibility in terms of time and commitment for the active care, custody, and welfare of a child immediately following that child’s birth or adoption. | |||

In addition to the enhanced parental leave, we will now extend Family Medical Leave (FML) coverage to include domestic partners.

Slow Re-Entry

We will be offering a Slow Re-Entry program that provides the employee with flexibility on return to work date/schedule to ease back in to full time employment during their first four weeks back at work.

#Participation in this program varies by brand. At the time you are preparing for your leave of absence, your eligibility for this program will be discussed and confirmed.

[fusion_menu_anchor name=”FSAs”/]Flexible Spending Accounts (FSAs)Back to top

Our FSA plans, administered by Benefit Resource Inc. (BRI) allows you to set aside pre-tax dollars for reimbursement of eligible health care and/or dependent care expenses.

To learn more about the FSA plans offered, access your personal FSA claim information, view a list of eligible expenses, access claim forms, and more visit www.BenefitResource.com, or call them at 1-800-473-9595.

[fusion_menu_anchor name=”CommuterBenefits”/]Commuter BenefitsBack to top

Our online commuter benefits plan, administered by Benefit Resource Inc. (BRI) provides you with the opportunity to pay for your commuting costs with pre-tax dollars (up to the IRS maximums). If this is your first time enrolling please read “Commuter Plan Fast Facts” found on in the toolbar on the left hand side of the page. If you have questions, need help enrolling, or need additional information please contact the benefitsPLUS solution center at 855-326-7870.

[fusion_menu_anchor name=”GVB”/]Group Voluntary BenefitsBack to top

Our Group Voluntary Plans offer additional protection in the event of an accident, illness, or hospitalization, as well as a plan which provides legal services. Our plans are all administered by AFLAC and MetLife. They are:

- Group Critical Illness Insurance (provided by Aflac) – helps you manage the cost of recovery if you are diagnosed with a major illness by paying a lump-sum benefit.

- Group Hospital Indemnity Insurance (provided by Aflac) – is designed to supplement your medical coverage by paying benefits in the event you’re hospitalized.

- Group Accident Insurance (provided by Aflac) – is designed to supplement your medical plan by paying benefits in the event of an accident that requires medical services.

If you have questions prior to enrolling in the plans or want to learn more about the AFLAC plans once you have enrolled, visit www.aflacgroupinsurance.com or call / email 1-800-433-3036 / cscmail@aflac.com

Group Legal Plan (provided by MetLife) – can help you resolve a wide range of legal issues through telephone advice or office visits on a variety of personal legal matters. To learn more about the MetLife Group Legal Plan, visit www.legalplans.com. When accessing the site, you’ll need our DAN code to see the plan details. The code is 6090023.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]